Are you looking for a stable and profitable investment opportunity in the United States? Look no further than high dividend US bank stocks. These stocks offer investors a chance to earn substantial returns on their investments while benefiting from the stability and reliability of the banking sector. In this article, we will explore the top high dividend US bank stocks and discuss why they are a lucrative investment option.

Understanding High Dividend Stocks

High dividend stocks are shares of companies that pay out a significant portion of their earnings to shareholders in the form of dividends. These companies tend to be well-established and financially stable, which makes them a safe bet for investors seeking regular income.

Why Invest in High Dividend US Bank Stocks?

Investing in high dividend US bank stocks can be an attractive option for several reasons:

Top High Dividend US Bank Stocks

Here are some of the top high dividend US bank stocks to consider:

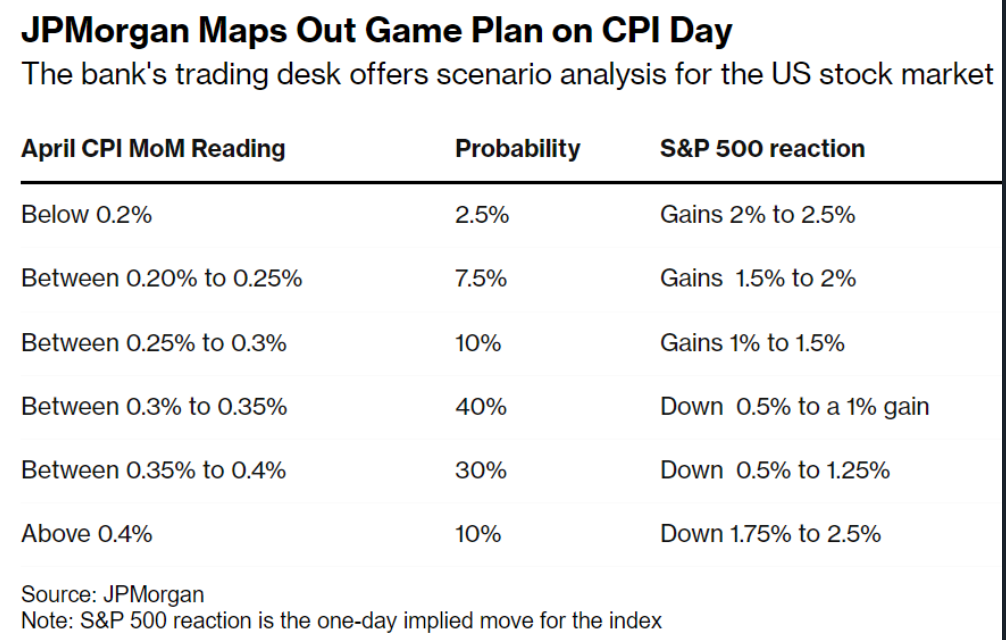

Case Study: JPMorgan Chase & Co.

Let's take a closer look at JPMorgan Chase & Co. as an example of a high dividend US bank stock. In the past five years, JPMorgan Chase has increased its dividend by 9.1%, providing investors with a growing income stream. Additionally, the company has a strong financial position and a history of generating consistent earnings, making it an attractive investment for dividend investors.

Conclusion

High dividend US bank stocks can be a lucrative investment option for those seeking stability, regular income, and potential capital gains. By investing in well-established banks like JPMorgan Chase, Bank of America, and Wells Fargo, investors can benefit from the stability and growth of the banking sector while earning a substantial return on their investments. As always, it's important to do your research and consult with a financial advisor before making any investment decisions.

nasdaq composite